For a comfortable retirement where you’re financially secure and can enjoy your leisure time, making regular pension contributions is crucial. Your pension pot serves as your financial foundation for the future.

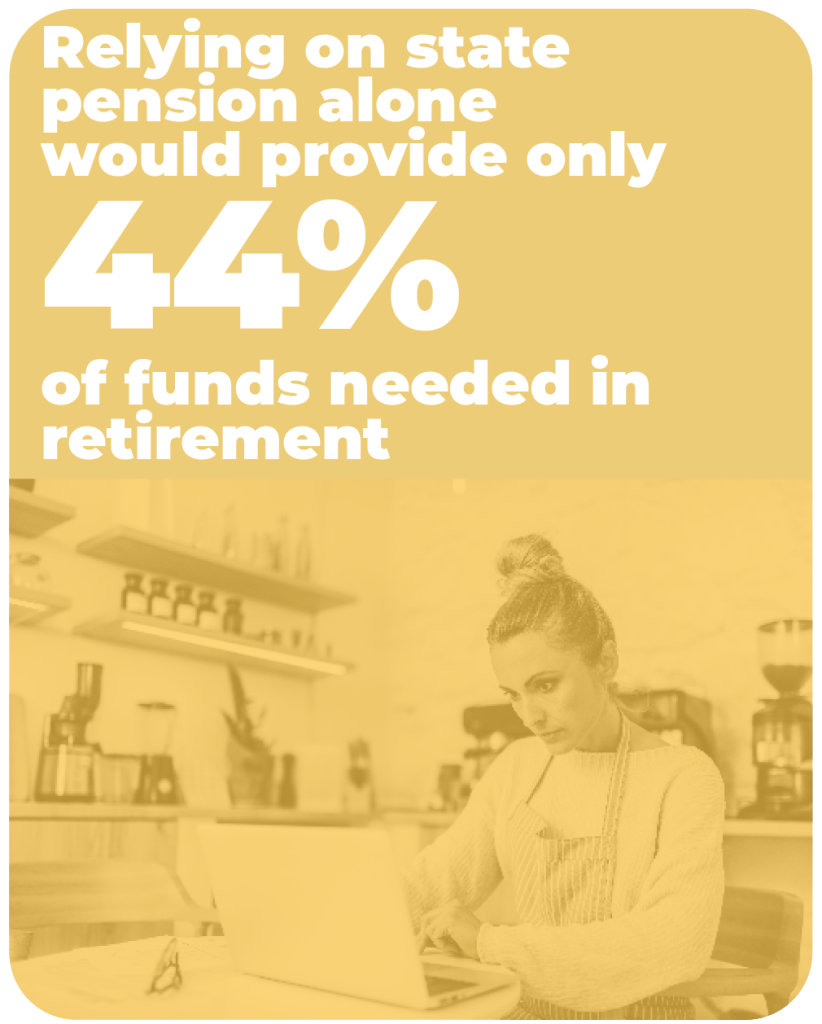

Pension contributions are vital for everyone, regardless of their employment status. Having a well-funded pension becomes even more critical considering the rising costs of living and the uncertainty surrounding state pensions. Even though the state pension is available to most individuals, it often falls short in providing a sufficient income for a comfortable retirement.

To bridge this gap, it’s essential to contribute to a personal pension plan. Personal pension contributions offer tax benefits, with taxpayers receiving extra incentives for their contributions. Maximising you contributions now can lead to significant rewards in the future.

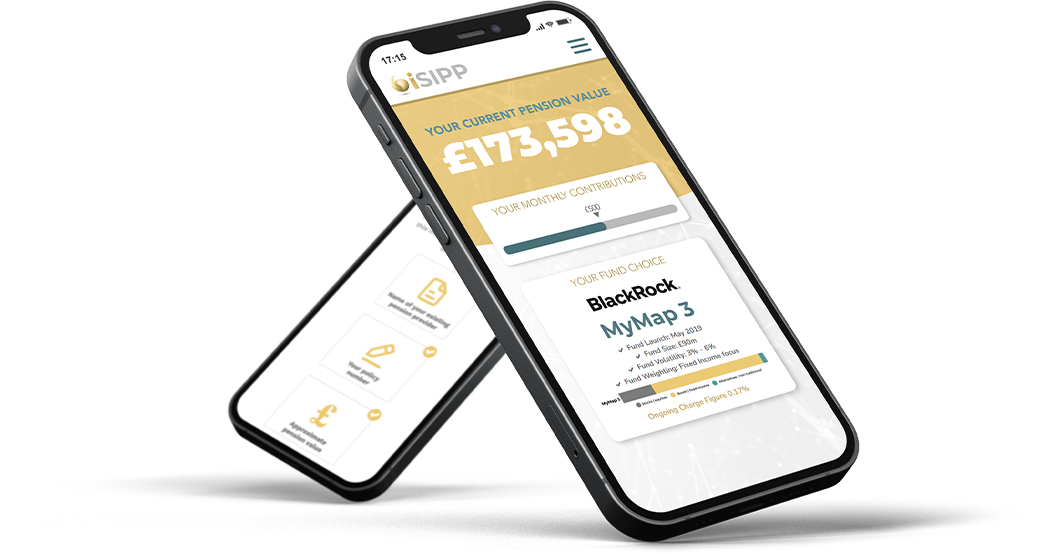

Taking charge of your pension planning and making regular contributions is crucial to ensure you have enough funds to support your desired lifestyle during retirement. To simplify the process and maintain consistency, you may consider using platforms like iSIPP, which offer easy pension management and allow you to set up automated contributions for added convenience.