Authorised and Regulated by the Financial Conduct Authority (FCA) and with over 25-years of pension expertise, you can have faith in our ability to look after your client’s future.

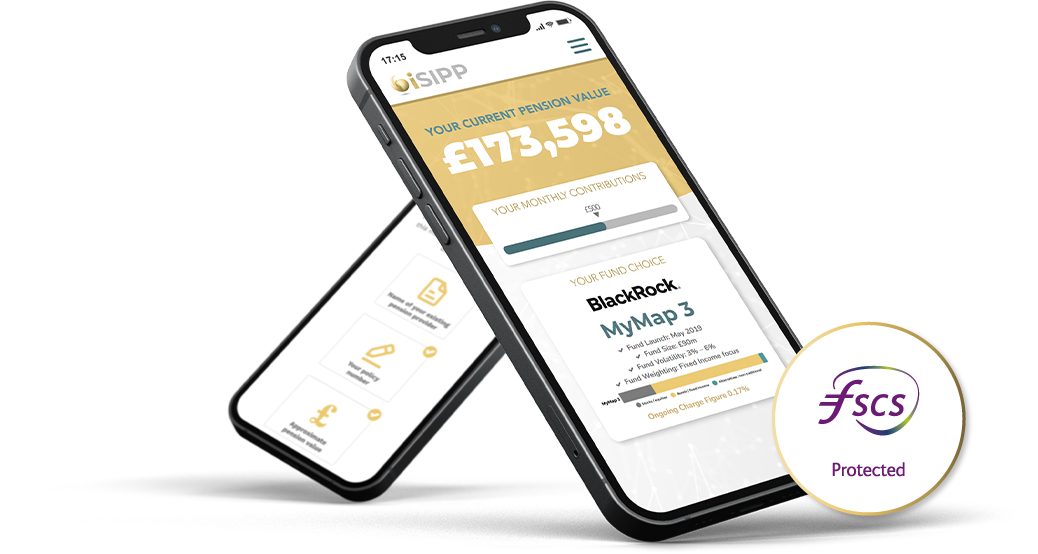

Investment funds we offer provide options to your clients who wish to keep their investments simple, but we also cater for your clients who need flexibility and want to create their own portfolio. Funds offered by our SIPP are managed by some of the most recognised and experienced fund managers, delivering peace of mind. Your pension is covered by the Financial Services Compensation Scheme (FSCS) too.

Clients who choose iSIPP:

Long-Term savers looking for tax efficiency

Individuals with diverse income sources

High earners maximising pension contributions

Individuals wanting flexibility in pension contributions

Individuals looking to consolidate pension pots

Individuals wanting simple retirement solution

Investors seeking control over their portfolio

Individuals wanting to plan inheritance