If you’re looking to make the most of your money, you may have heard about pension consolidation.

Did you know that you may have thousands of pounds of unclaimed pension savings out there? As you move through life, you could have changed jobs several times, enrolling onto new employer pension schemes each time.

You may have also moved house every few years and forgotten to tell your pension provider your new address. This means there could be several pots of hard-earned savings not accounted for.

Research from the Association of British Insurers revealed that £19.4 billion worth of pensions have gone unclaimed in the UK due to moving house alone. Therefore, many people choose to merge their old pensions.

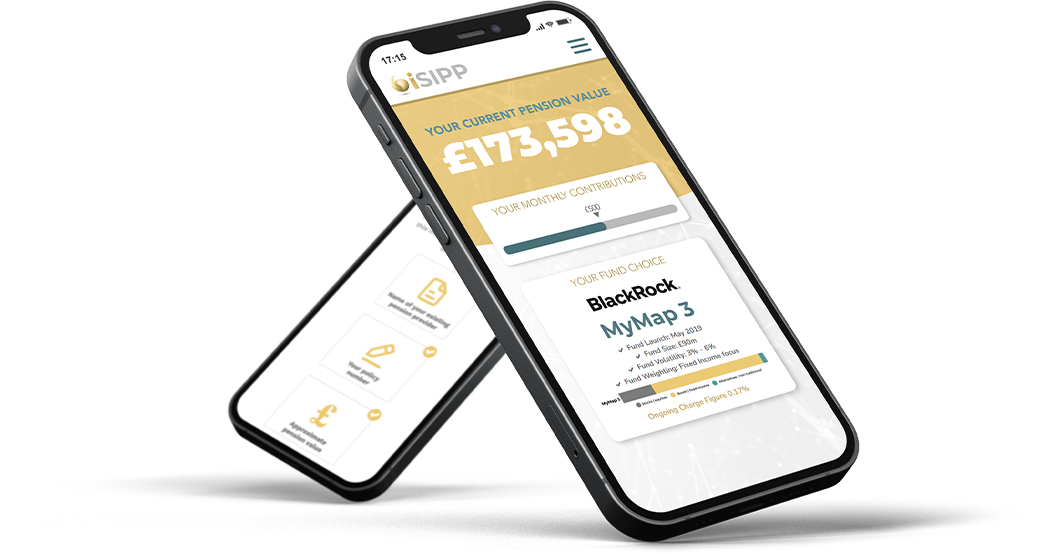

But what does this mean? Essentially, pension consolidation is what it sounds like—combining many individual pension funds into one larger sum. After tracking down their old pension pots, many people then choose to consolidate all their past pensions into one easy to manage SIPP.