Up to 2.9 million ‘consider’ pension cuts as cost of living bites

Up to 2.9 million people saving into pensions are considering cutting contributions this year as the cost-of-living squeeze continues to put pressure on budgets.

Our research* found it is 35 to 54-year-olds who are most likely to reduce or stop pension contributions accounting for nearly half (46%) of the people considering cutbacks.

Around 1.3 million 35 to 54-year-olds are looking to reduce the amount they save for retirement this year compared with around 770,000 18 to 34-year-olds and around 800,000 over-55s.

More men are considering reducing pension contributions compared with women – we estimate 1.542 million men could cut back compared with around 1.356 million women.

There is good news on the pension front in the study. Pension contributions are among the last to be considered for cuts. People are much more likely to have turned down heating or stopped buying clothes.

Around 46% of people have only put on heating when necessary while 44% have cut back on clothes spending compared with one in 20 (5%) considering cutting pension contributions. However, people are less likely to cut back on insurance (4%) or sell their car (3%).

There is a longer-term issue for pensions too from the research. Pensions are a lower priority for regular monthly contributions when people were asked to pick their top three. Just 95 chose pensions among their top three compared with 72% choosing utilities and 45% opting for mortgage or rent. Around 12% chose TV streaming services.

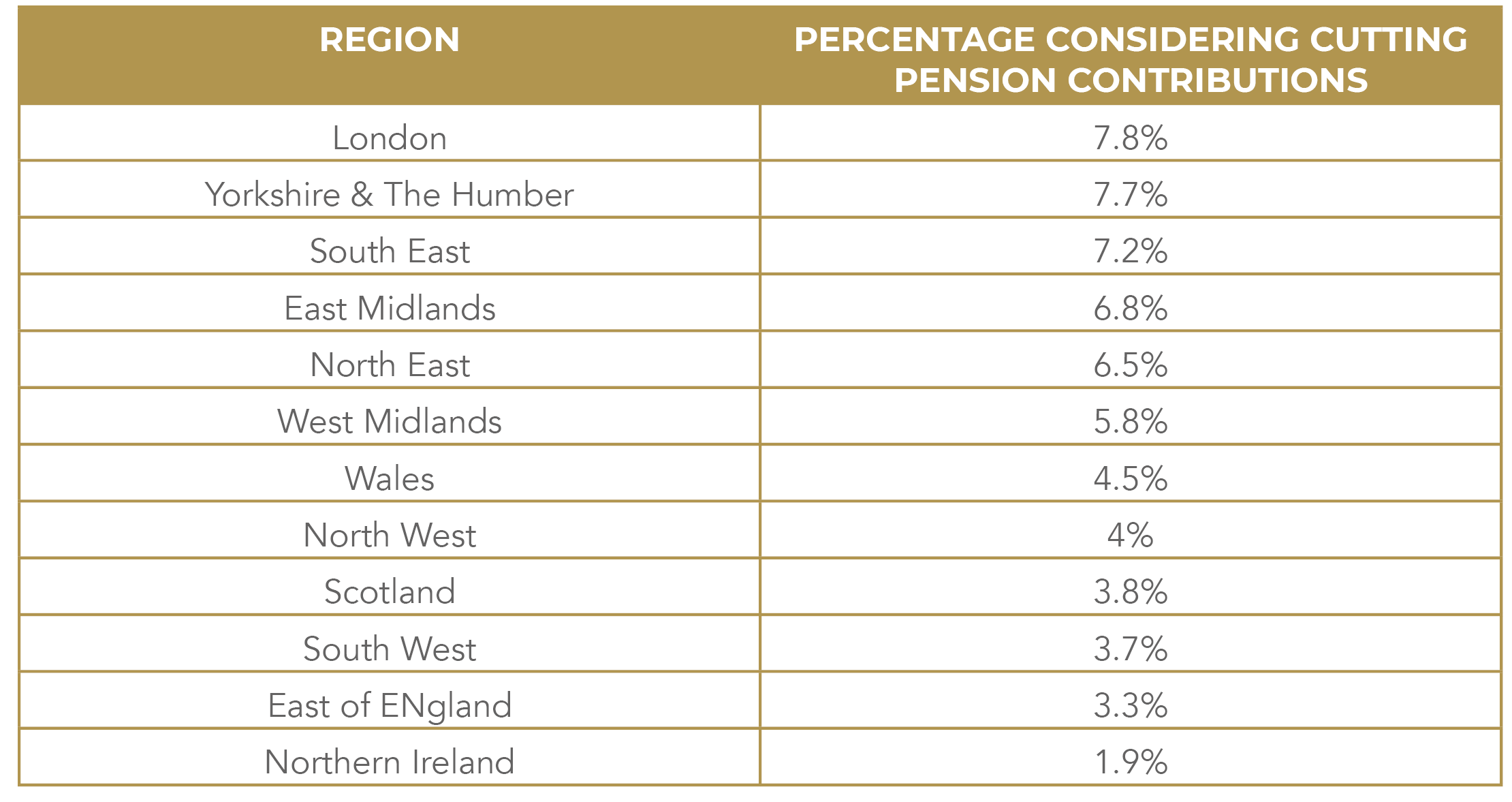

The research found Londoners are the most likely to consider cutting down on pension contributions this year as the table below shows.

iSIPP Managing Director Hrishi Kulkarni said: “People should think carefully about stopping pension contributions as while it will save money for a month or two, the financial impact will be long-term and mean a lower income in retirement.

“It is particularly worrying to see that people aged between 35 and 54 are the most likely to reduce pension contributions as they should be the years when people are earning the most and can afford pension contributions. Over-55s who cut back on pensions are taking a major risk in the run-up to retirement.

“The silver lining to the cloud over pensions is that they are among the last financial commitments considered for cutbacks as incomes are squeezed. It is less reassuring to find that pensions don’t make it higher up people’s list of priorities although entirely understandable what the top three are.”

iSIPP helps UK and international customers to consolidate their UK pensions. Sign-up is easy at www.isipp.co.uk. As well as pension consolidation we also offer regular and ad-hoc contributions. Our service is particularly suited to the self-employed and contractors or those who have become self-employed recently as they can combine all their existing pensions and flexibly manage there savings online.

Our free to set up service has no dealing charges or charges to transfer in existing pension funds and enables clients to create their own investment portfolio complementing our existing ‘Choice’ range of Ready-Made funds from world-leading fund managers BlackRock and Schroders.

Our digital pension consolidation service is available to all customers with UK pension funds who are working or have worked in the UK. Built around flexibility, we provide access to over 100 funds under its ‘Create’ option allowing users to build their own portfolio. Our ‘Choice’ range include Ready-Made Portfolios from world-leading fund managers BlackRock and Schroders. BlackRock’s multi-asset, risk-managed MyMap range of funds are available which include an ESG fund and we also provide access to the Schroders’s Shariah compliant fund. Focusing on transparency, the annual trust fee is £200 plus a 0.25% platform services fee. Funds with OCF (Ongoing Charges Figure) start at as low as 0.16%.

- * Study conducted by independent research company Opinium among a nationally representative sample of 2,000 UK adults aged 18-plus between January 10th and 13th 2023 using an online methodology.

Disclaimer

The content of this article is for general information purposes only and should not be construed as legal, financial or taxation advice. You should not rely on the information contained in this article as legal, financial or taxation advice. The content of this article is based on information currently available to us, and the current laws in force in the UK. The content does not take account of individual circumstances and may not reflect recent changes in the law since the date it was created. It is essential that detailed financial and tax advice should be sought in both jurisdictions and any legal advice, if required.

This notice cannot disclose all the risks associated with the products we make available to you. When making your own investment decisions it is important you understand that all investments can fall as well as rise in value and it is possible you may get back less than what you have paid in. You should also be satisfied that any investments you choose are suitable for you in the light of your circumstances and financial position. You should seek financial advice if you are not sure of what’s best for your situation.