The pension annual allowance increase to £60,000: How could it impact your retirement savings?

In the 2023 spring budget, Chancellor Jeremy Hunt announced an increase in the annual allowance for pension contributions from £40,000 to £60,000. This change has significant implications for individuals who contribute to their pension pots, particularly those who can now afford to contribute more.

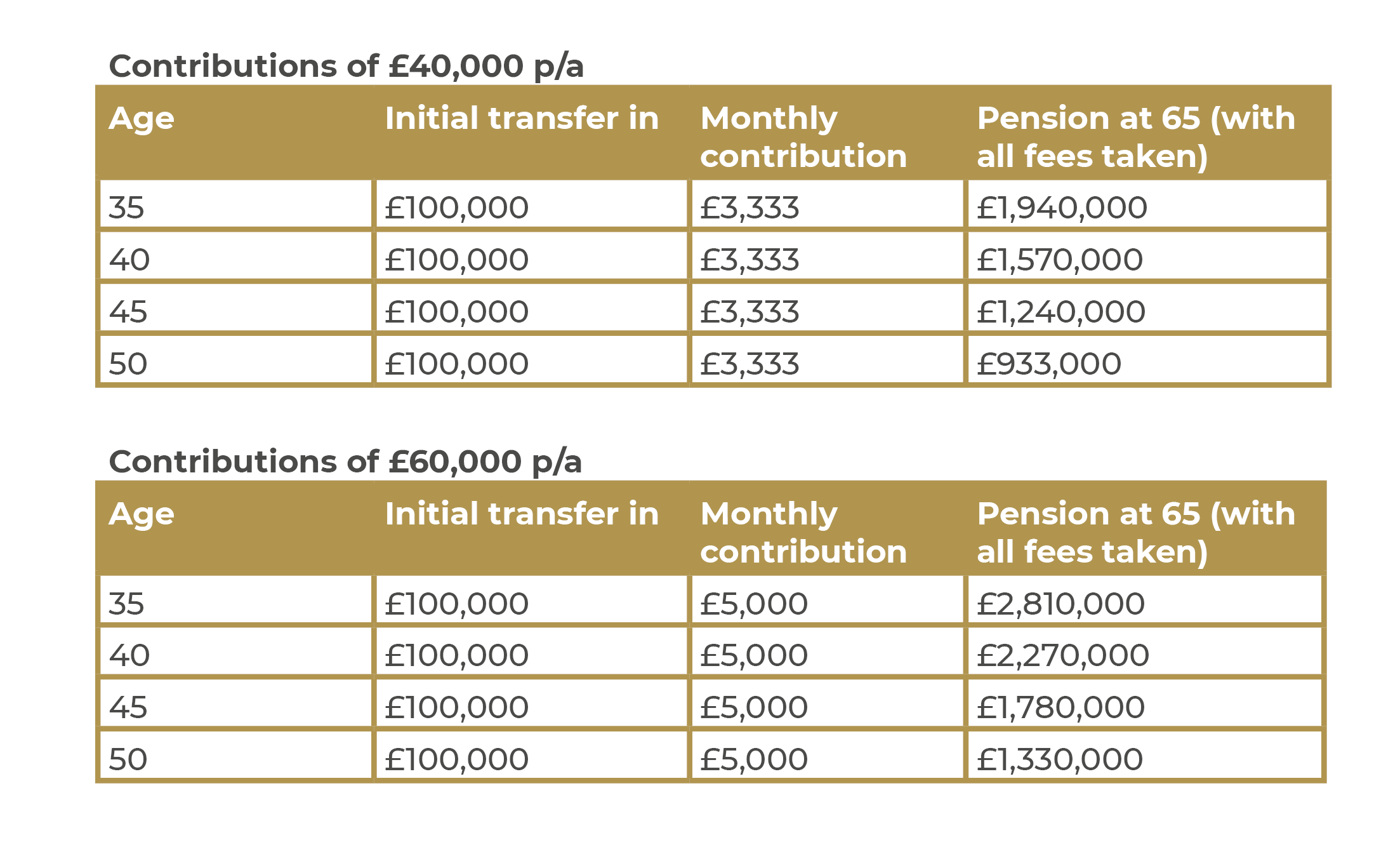

To illustrate the difference that this change in annual allowance can make, let’s take a look at the data in the table below. The table shows the pension pots of individuals who contribute either £40,000 or £60,000 per year, assuming an initial transfer of £100,000 and monthly contributions. All iSIPP fees are taken into account, and the pension pots are estimates based on retirement at age 65.

Firstly, let’s look at the pension pots of individuals who contribute £40,000 per year. At age 35, an individual who contributes £40,000 per year can expect to have a pension pot worth approximately £1,940,000 at age 65. Similarly, a 40-year-old who contributes £40,000 per year can expect a pension pot of around £1,570,000, while a 45-year-old can expect a pot of £1,240,000. Finally, a 50-year-old who contributes £40,000 per year can expect a pension pot of around £933,000.

Now, let’s compare these figures to the pension pots of individuals who contribute £60,000 per year. At age 35, an individual who contributes £60,000 per year can expect to have a pension pot worth approximately £2,810,000 at age 65. Similarly, a 40-year-old who contributes £60,000 per year can expect a pension pot of around £2,270,000, while a 45-year-old can expect a pot of around £1,780,000. Finally, a 50-year-old who contributes £60,000 per year can expect a pension pot of around £1,330,000.

The difference between these two sets of figures is striking. For example, a 35-year-old who contributes £60,000 per year can expect a pension pot worth £870,000 more than a 35-year-old who contributes £40,000 per year. Similarly, a 50-year-old who contributes £60,000 per year can expect a pension pot worth around £397,000 more than a 50-year-old who contributes £40,000 per year.

Of course, it’s worth noting that these figures are based on several assumptions, and that there are many other factors that can impact the size of a pension pot. For example, investment performance and the fees charged by pension providers can both have a significant impact on the final value of a pension pot.

However, even taking these factors into account, the increase in the annual allowance from £40,000 to £60,000 is a significant one and has the potential to make a real difference to the retirement prospects of those who can afford to take advantage of it. By increasing the amount that individuals can contribute to their pension pots each year, the government has provided a valuable opportunity for people to boost their retirement savings and secure a more comfortable retirement.

End of tax year

It is worth noting that the 5th April deadline for contributing to your pension is approaching. Contributing before this deadline can be a wise financial decision as it can enable you to take advantage of tax relief, reduce your tax bill, and boost your retirement savings. The annual allowance for pension contributions for 2022/23 cis £40,000, and it is essential to consider maximising your allowance before the deadline to avoid missing out on tax benefits.

If you are ready to combine your pensions iSIPP can help you. Start your journey today and take the first steps towards a more secure financial future.

These calculations are not a reliable indicator of future performance and is intended for general information purposes only, as an aid to decision-making, not a guarantee. Learn more about the purpose of this calculations and how to read the results.

- For the purposes of this illustration, the FCA require us to provide you with an indication of your projected pension fund value you may get at your illustrated retirement age at 65. The illustrative value is based on prescribed Mid investment growth rate of 5%, after allowing for all fees and charges.

- The projection assumes that you do not draw any income or one-off lump sums from the SIPP. It also assumes the value of your pension fund is within the standard Lifetime Allowance and no LTA tax charge applies.

- In addition, we are required to reduce the projected figures to account for inflation. Inflation is the rise in costs of goods and services over time.

- This illustration incorporates our fees as per our fee schedule. Fixed monetary fees are assumed to increase each year in line with inflation.

- Ongoing Charges Figure (OCF): This illustration incorporates an assumed Ongoing Charges Figure (OCF) 1.00% for the purposes of generating this illustration.

- The figures are for illustration purposes only and are not guaranteed. The value of the SIPP depends on how your investments perform after charges and fees.

These calculations use the assumptions below:

- The purpose of this is to give you a general indication of your fund value at an illustrated retirement age (please read the assumptions used) based on your current age and the transfer amount.

- This does not constitute personal advice. You are advised to seek independent financial advice.

- The figures are a guide only; they are not guaranteed. Your final pension fund, and the income available from it, will depend upon a range of factors. These include, but are not limited to, contributions you make in future, the growth of your fund, charges, inflation, annuity rates and options, and your retirement age.

- The value of investments can go down as well as up and you may get back less than you invest.

- This does not take account of any tax charges which may apply to contributions into or income from a pension or any tax applicable if your fund exceeds the lifetime allowance at the time of retirement.

- This is not appropriate for calculating potential income from a defined benefits scheme.

This calculation does not take into account any benefits from a state pension.

Disclaimer

The content of this article is for general information purposes only and should not be construed as legal, financial or taxation advice. You should not rely on the information contained in this article as legal, financial or taxation advice. The content of this article is based on information currently available to us, and the current laws in force in the UK. The content does not take account of individual circumstances and may not reflect recent changes in the law since the date it was created. It is essential that detailed financial and tax advice should be sought in both jurisdictions and any legal advice, if required.

This notice cannot disclose all the risks associated with the products we make available to you. When making your own investment decisions it is important you understand that all investments can fall as well as rise in value and it is possible you may get back less than what you have paid in. You should also be satisfied that any investments you choose are suitable for you in the light of your circumstances and financial position. You should seek financial advice if you are not sure of what’s best for your situation.