Pension saving 'will bounce back from cost-of-living crisis'

Retirement saving will bounce back from the ongoing cost of living crisis despite taking a hit as pension savers cut the frequency of payments, the amounts they contributed, and even stopped saving entirely, according to our latest research* .

Our research* found that nearly half (45%) of people who save into company or personal pensions have taken action to reduce the amount they contribute. More than a quarter (28%) have reduced the amount they save or the frequency of payments while 17% have stopped entirely.

But the cuts are not permanent with just one in 10 (11%) saying they will never restart pension saving even if they can afford to. People who have cut back are most likely to restart saving within three to six months although 15% say they are waiting for the economy to recover significantly.

Our research shows people who have cut back in the past year have reduced pension payments before. Around 44% said they had stopped saving into pensions once or even multiple times.

And it’s not all one-way traffic on pension cuts – around one in eight (12%) questioned say they have increased the amount they save, restarted saving or started saving for the first time in the past year.

Our study found the main reason for cutting pension saving was the financial squeeze – nearly a third (31%) said they have more pressing financial needs while 27% said the rising cost of living meant they could no longer afford pension payments.

Nearly one in five (18%) said they had not had a pay rise so had to cut back while 17% blamed pay cuts or job losses for their reduced pension contributions.

As a pension provider, our specialty is UK and international customers who wish to consolidate UK pensions. We enable customers to sign up easily here and also offer regular and ad-hoc contributions. Our service is particularly suited to the self-employed and contractors or those who have become self-employed recently as they can combine all their existing pensions.

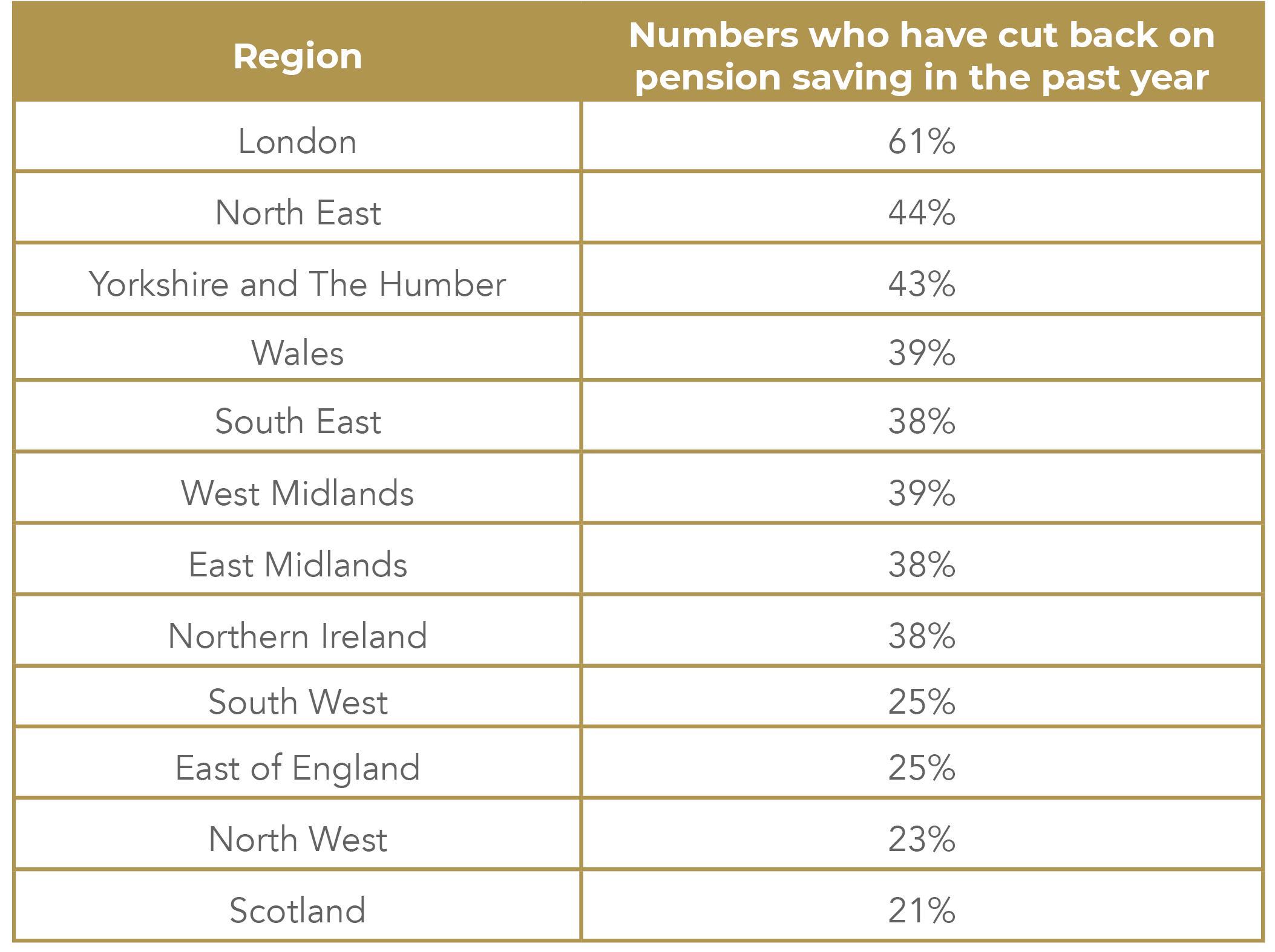

The table below shows that Londoners are the most likely to have reduced the frequency or amount of pension payments or stopped completely. Around 61% in the capital say they have cut back while only 21% of Scots say they have cut back on pensions.

iSIPP Managing Director, Hrishi Kulkarni, said: “The past year has been financially tough for many people and while it is disappointing that so many have reduced pension contributions or stopped entirely, it is possibly not that surprising.

“What is encouraging is that the vast majority plan to restart pension saving and in many cases may have already done so since our research was conducted. Many it seems have cut back on pension saving before and started again.

“Stopping saving into a company pension, in particular, will mean losing out on employer contributions and can have a major effect on final retirement income while anyone stopping pension saving will lose tax relief. It makes sense to prioritise pension saving even when finances are under strain.”

Our free to set up service has no dealing charges or charges to transfer in existing pension funds and enables clients to create their own investment portfolio complementing our existing ‘Choice’ range of Ready-Made funds from world-leading fund managers BlackRock and Schroders.

Our digital pension consolidation service is available to all customers with UK pension funds who are working or have worked in the UK. Built around flexibility, we provide access to over 100 funds under our ‘Create’ option allowing users to build their portfolio. Our ‘Choice’ range includes Ready-Made Portfolios from world-leading fund managers BlackRock and Schroders. BlackRock’s multi-asset, risk-managed MyMap range of funds is available which includes an ESG fund, and we also provide access to the Schroders’s Shariah compliant fund. Focusing on transparency, the annual trust fee is £200 plus a 0.25% platform services fee. Funds with OCF (Ongoing Charges Figure) start at as low as 0.16%.

- * Study conducted by independent research company Opinium among a nationally representative sample of 2,000 UK adults aged 18-plus between January 10th and 13th 2023 using an online methodology

Disclaimer

The content of this article is for general information purposes only and should not be construed as legal, financial or taxation advice. You should not rely on the information contained in this article as legal, financial or taxation advice. The content of this article is based on information currently available to us, and the current laws in force in the UK. The content does not take account of individual circumstances and may not reflect recent changes in the law since the date it was created. It is essential that detailed financial and tax advice should be sought in both jurisdictions and any legal advice, if required.

This notice cannot disclose all the risks associated with the products we make available to you. When making your own investment decisions it is important you understand that all investments can fall as well as rise in value and it is possible you may get back less than what you have paid in. You should also be satisfied that any investments you choose are suitable for you in the light of your circumstances and financial position. You should seek financial advice if you are not sure of what’s best for your situation.