North East is the cheapest place to be a pensioner

Our latest analysis* shows that The North East of England is the cheapest place to be a pensioner with over-65s needing an annual income of £14,782 to cover spending.

Retired people in the North East spend just over £3,000 a year less than the national average and up to £6,768 than in London and the South East.

Our analysis of the most recent Government data on family spending shows average over-65s spend £17,810 a year with food, housing costs and transport accounting for around 43% of total annual spending.

Those aged between 65 and 74 spend an average of nearly £20,000 a year but annual average spending among those aged 75-plus drops to £15,680.

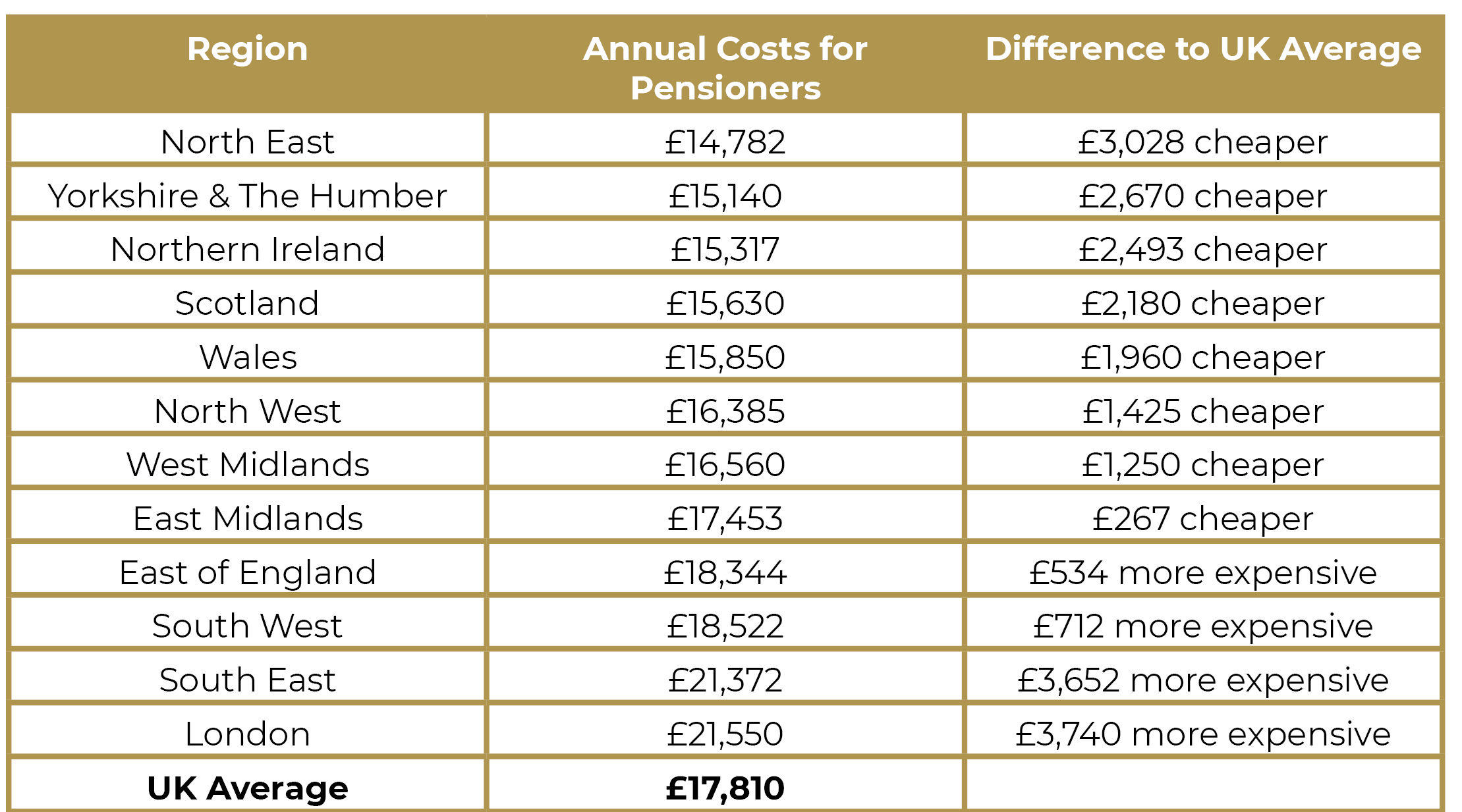

Average national spending however only tells part of the story and where pensioners live has a major impact on how much they spend a year on average.

Housing and maintenance costs plus spending on food and transport including fuel prices and the cost of alcoholic drinks and clothes mean there are major regional differences in the cost of being a pensioner.

Over-65s in London and the South East need the biggest incomes, the analysis found. In London over-65s spend £21,550 while costs drop slightly outside the capital in the wider South East of England to £21,372.

Over-65s in the South West and East of England also spend more than the national average but the extra spending is only £712 and £534 a year, respectively.

The spending figures are a useful guide to how much income people will need in retirement to meet basic costs but urges retirement savers to remember the data only focuses on averages.

The table below shows the spending figures across the country and how much cheaper or more expensive each region is compared with the national average.

Here at iSIPP, we help UK and international customers to consolidate their pensions online following an easy sign up at www.isipp.co.uk. Our service is particularly suited to those who have built up multiple pension funds as they can combine all their existing pensions.

iSIPP Managing Director Hrishi Kulkarni said: “Where you live in the country can make a massive difference to how much you will spend a year in retirement with the North East of England the cheapest place currently to be a pensioner.

“However, pensioners cannot simply move to another part of the country on retirement to benefit from a lower cost of living and average figures do not tell the whole story. What is clear is that people need to save as much as possible for retirement as the basic spending of £17,810 is not covered by the State Pension alone, which is currently worth around £10,600 a year.

“Anyone with multiple pension funds should look to combine them as consolidation could substantially save money and help increase the funds available to them at retirement. iSIPP makes it easy to combine pensions, make contributions and gives you control over your investments.”

Our free to set up service has no dealing charges or charges to transfer in existing pension funds and enables clients to create their own investment portfolio complementing its existing ‘Choice’ range of Ready-Made funds from world-leading fund managers BlackRock and Schroders.

Our digital pension consolidation service is available to all customers with UK pension funds who are working or have worked in the UK. Built around flexibility, we provide access to over 100 funds under our ‘Create’ option allowing users to build their own portfolio. Our ‘Choice’ range include Ready-Made Portfolios from world-leading fund managers BlackRock and Schroders. BlackRock’s multi-asset, risk-managed MyMap range of funds are available which include an ESG fund and we also provides access to the Schroders’s Shariah compliant fund. Focusing on transparency, the annual trust fee is £200 plus a 0.25% platform services fee. Funds with OCF (Ongoing Charges Figure) start at as low as 0.16%.

- *iSIPP analysis of data from here

Disclaimer

The content of this article is for general information purposes only and should not be construed as legal, financial or taxation advice. You should not rely on the information contained in this article as legal, financial or taxation advice. The content of this article is based on information currently available to us, and the current laws in force in the UK. The content does not take account of individual circumstances and may not reflect recent changes in the law since the date it was created. It is essential that detailed financial and tax advice should be sought in both jurisdictions and any legal advice, if required.

This notice cannot disclose all the risks associated with the products we make available to you. When making your own investment decisions it is important you understand that all investments can fall as well as rise in value and it is possible you may get back less than what you have paid in. You should also be satisfied that any investments you choose are suitable for you in the light of your circumstances and financial position. You should seek financial advice if you are not sure of what’s best for your situation.